Deducting Drought Damage from 1980 Income Tax Returns: Guidelines on Proving Subsoil Shrinkage and Estimating Property Damage, 1981-01-01 - 1981-12-31

Item — Box: 4, Folder: 2

Identifier: CAC_CC_109_4_22_2_0014

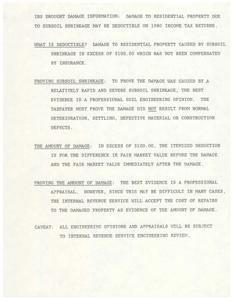

The IRS allows for deductions on income tax returns for damage to residential property caused by subsoil shrinkage in excess of $100 that has not been compensated by insurance. To prove the damage, a professional soil engineering opinion is recommended. The amount of damage can be determined by the difference in fair market value before and after the damage, with a professional appraisal being the best evidence. If repairs are not made until the following year, the loss can still be deducted in the year it occurred. Casualty losses under $100, losses compensated by insurance, damage to trees, bushes, or landscaping are not deductible unless caused by rapid, severe, and unusual subsoil shrinkage. The taxpayer must file an amended return if necessary.

Dates

- 1981-01-01 - 1981-12-31

Language of Materials

English

Conditions Governing Access

Certain series of this collection are stored off-site and require prior notice to access. If you wish to view these materials, please contact the Congressional Archives staff to arrange an appointment.

The following series are stored off-site: Clippings, Invitations, White House Records, and 2017 Accrual.

The following series are stored off-site: Clippings, Invitations, White House Records, and 2017 Accrual.

Extent

2 Pages

Overview

95th (1977-1979)

Repository Details

Part of the Carl Albert Center Congressional and Political Collections Repository